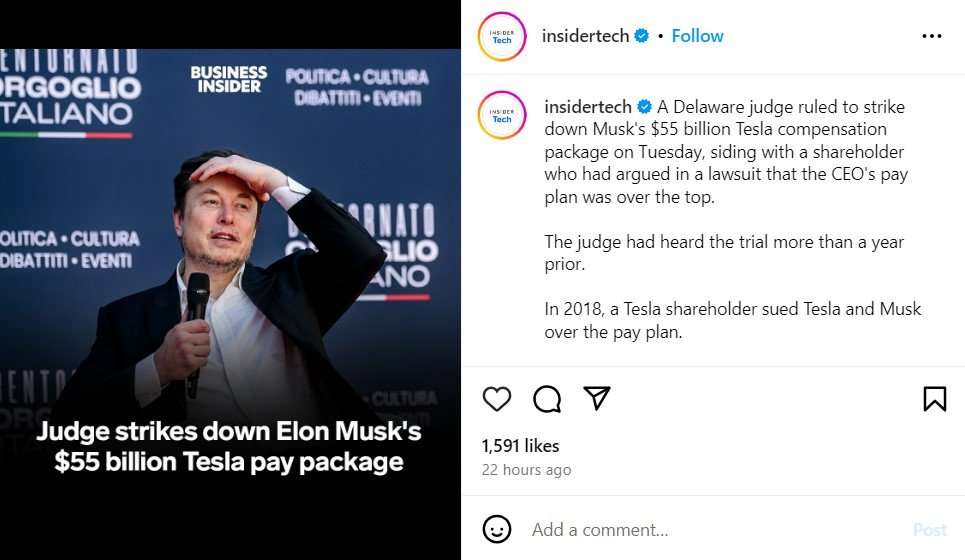

Elon Musk’s unprecedented $56 billion pay package, granted for his role as Tesla’s CEO, has been invalidated by a Delaware judge. This landmark decision, resulting from a lawsuit by Tesla shareholder Richard Tornetta, challenges the fairness and enormity of the compensation. Musk, known for his significant wealth and influence, received this pay package in 2018, which included stock grants amounting to 1% of Tesla’s equity for each of 12 tranches of escalating operational and financial goals achieved by the company.

Legal Perspectives and Shareholder Reactions

- Kristin Hull, NIA Impact Capital: Hull points out the decision underscores the influence shareholders can wield, especially when a board appears too compliant with the CEO.

- Adam Badawi, UC Berkeley: Badawi suggests the ruling may not directly reduce Musk’s wealth but emphasizes the need for a new, more justifiable compensation approach.

- Ross Gerber, Gerber Kawasaki Wealth & Investment Management: Gerber highlights the necessity for an independent board to negotiate any new pay package for Musk.

- John Coffee, Columbia University Law School: Coffee anticipates Musk may appeal, though a dramatic board shakeup might not be necessary.

The Lawsuit’s Core and Musk’s Defense

The lawsuit initiated by Tornetta in 2018 critiqued the pay package as excessive and not essential for Musk’s motivation, given his substantial stake in Tesla. The defense argued the package aligned Musk’s incentives with shareholders’ interests and was pivotal for the company’s growth, particularly during the Model 3 production ramp-up.

Read: Neuralink Human Trials: First Brain Chip Implanted in Groundbreaking Procedure

Looking Ahead: Possible Outcomes and Challenges

The judge’s finalization of the ruling and determination of compensation for Tornetta’s legal representation are pending. Musk, who may likely appeal, has seen his wealth burgeon due to Tesla’s stock performance, irrespective of this package. Discussions about a new compensation scheme have been on hold, awaiting the resolution of this case. Any new compensation plan will need to balance fairness with the company’s and shareholders’ interests.

Market and Analyst Reactions

Investor Sentiments: Varied perspectives emerged among Tesla investors and market analysts. Some see the ruling as a necessary check on corporate governance, while others fear potential impacts on Tesla’s valuation and Musk’s future involvement in the company.