TELUS Corporation (T.TO), a prominent player in the telecommunications sector, has been a subject of keen interest among investors and market analysts. Here is the recent performance of TELUS stock, its presence on the New York Stock Exchange, share dynamics, and dividend policies, providing a holistic view of its market position that will help you to decide whether you should buy, sell or hold its stocks.

Current Stock Price and Market Performance

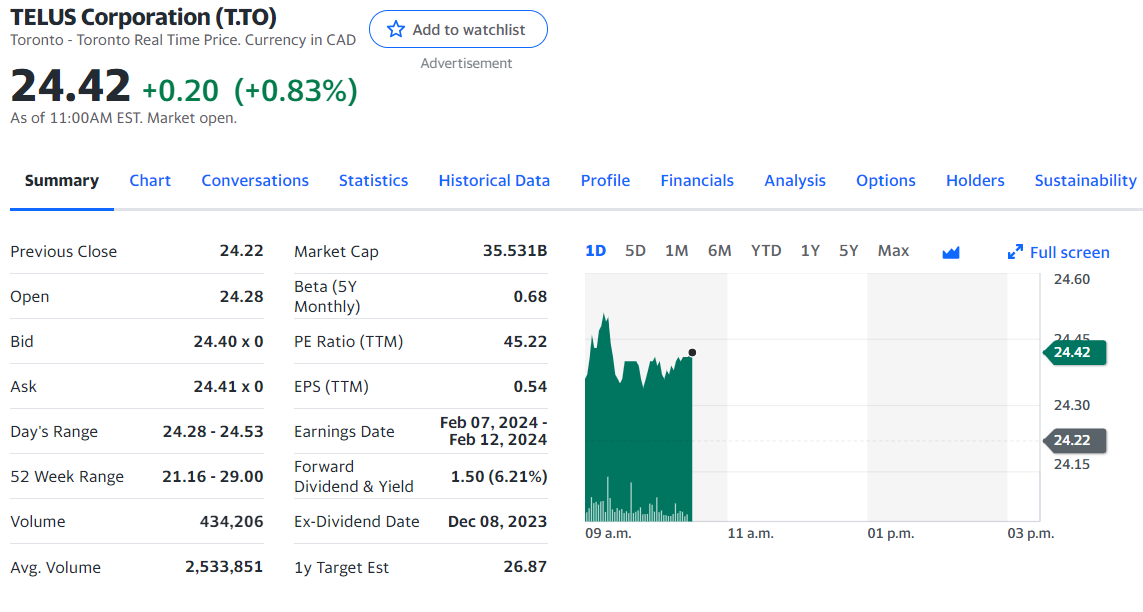

As of the latest data, TELUS Corporation’s stock opened at $18.17, with a day range fluctuating between $18.13 and $18.38. The 52-week range has been noted from $15.47 to $21.82, reflecting the stock’s volatility and market response over the past year. The company’s market capitalization stands at a robust $26.24 billion, supported by 1.46 billion shares outstanding and a public float of 1.45 billion.

TELUS on the New York Stock Exchange

TELUS’s presence on the New York Stock Exchange (NYSE) under the ticker symbol ‘TU’ signifies its global reach and the confidence of international investors. The stock’s beta value of 0.73 indicates lower volatility compared to the broader market, making it a potentially stable investment choice.

Share Dynamics and Investor Sentiment

The company’s earnings per share (EPS) is currently at $0.41, with a price-to-earnings (P/E) ratio of 44.27. This ratio is a critical indicator for investors, reflecting the company’s profitability and growth potential. Additionally, TELUS’s revenue per employee stands at $135.81K, showcasing its operational efficiency.

Read: JPMorgan Chase’s Triumph and Trials: Record Profits and Bankruptcy Probabilities in 2024

Dividend Policy and Returns

TELUS has been consistent in its dividend policy, with a current yield of 5.98%. The dividend per share is $0.28, and the last ex-dividend date was recorded on December 8, 2023. This consistent dividend payout is a testament to the company’s financial health and commitment to shareholder value.

Performance Metrics

Over different time frames, TELUS stock has shown varied performance: a 1.42% increase over 5 days, a 1.48% rise over the past month, and an 8.77% growth in the last three months. However, the year-to-date (YTD) change stands at 2.16%, with a -13.53% shift over the past year, highlighting the challenges and resilience in a dynamic market environment.

Company Overview

Founded on October 4, 1990, and headquartered in Vancouver, Canada, TELUS Corp. operates through segments like TELUS Technology Solutions (TTech) and Digitally-led Customer Experiences–TELUS International (DLCX). These segments encompass a range of services from mobile technologies, data revenues, healthcare software, and digital customer experience solutions, underlining the company’s diverse and innovative approach.